Use the “Fuel Tank Arrow” Concept to Improve Client Experience

When we travel, we sometimes go on road trips and rent a car.

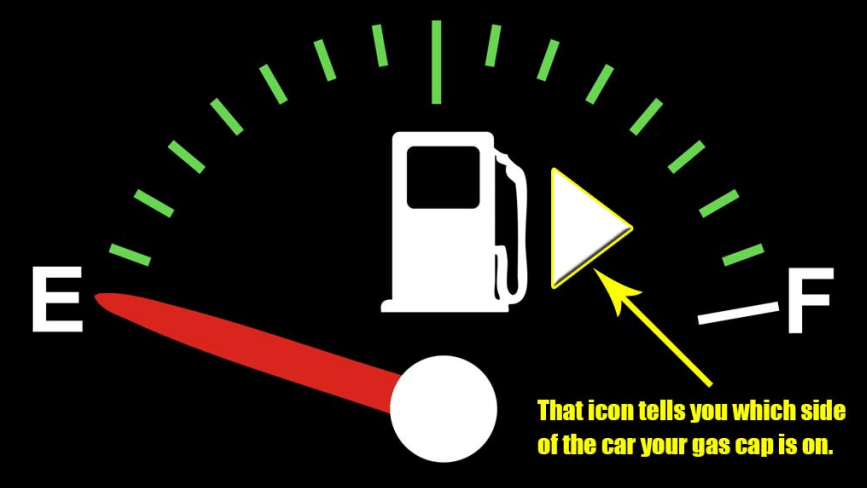

A small useful tip was to look for the arrow next to the fuel gauge (Unless you have an EV) when we are about to pull up to a gas/petrol station.

The direction of the arrow tells you which side the fuel tank is on.

This tiny detail saves you time and prevents the frustration of guessing the wrong side.

It’s an example of great user experience design: small, thoughtful, and incredibly helpful.

So, what does this have to do with mortgage broking?

A lot, actually!

The Fuel Tank Arrow is a reminder of how little changes can make a big impact on customer experience.

Let’s explore how mortgage brokers can take this concept and apply it to create a better experience for their clients.

Clear, Easy-to-Understand Guidance

The Fuel Tank Arrow provides instant clarity.

Similarly, in mortgage broking, clients often feel overwhelmed by complex terms and documentation.

A simple way to help them is by offering clear explanations and visual aids.

For instance, creating a glossary of key terms or an infographic that breaks down the loan approval process can make it easier for clients to understand where they are in their journey.

Example: Just as the arrow shows you the side of the fuel tank, a visual checklist for clients might show them what documents they need at different stages of their loan application.

This keeps them informed and reduces uncertainty.

Proactive Communication

Just like how the arrow points out something important before you even need it, keeping your clients informed throughout the mortgage process can save them stress and confusion.

Many clients feel anxious because they don’t know what’s happening behind the scenes.

You can change that by sending status updates via email or text at key stages of their loan application. Some CRM systems can help you automate this process.

This way, they always know what’s going on without needing to ask.

Example: A message like “Your application has been submitted today” acts like the fuel arrow—letting the client know where they stand and what comes next.

Anticipating Client Needs

The Fuel Tank Arrow is there for you before you make a mistake.

Similarly, great customer experience is about anticipating your client’s needs.

Mortgage brokers can do this by addressing common client pain points ahead of time.

For example, providing a simple FAQ section on your website about loan processes, or offering a loan calculator tool so clients can estimate their repayments before even speaking to you.

Example: Many clients worry about whether they can afford a home. An easy-to-use calculator on your website helps them feel more confident before they even reach out for advice—much like knowing where the fuel cap is before you get to the petrol station.

Personalised Solutions

Not every car’s fuel tank is on the same side, and not every client has the same financial situation.

Customizing the approach to fit each client’s needs is key to providing a great experience.

This could involve offering personalised loan options based on their income, goals, and risk tolerance.

Example: Just as the fuel arrow adapts to different car models, your advice should adapt to each client.

Offering the right loan products or taking extra time to explain options that fit their unique situation shows you’re paying attention to their individual needs.

Follow-Up and Aftercare

The fuel tank arrow is always there, a small but constant guide.

Similarly, your relationship with clients shouldn’t end at settlement.

A post-settlement follow-up—such as a check-in email or phone call—shows your ongoing commitment to their financial well-being.

Example: Send a friendly follow-up a few months after settlement to see how your client is adjusting. You could offer advice on reviewing their interest rates or managing their mortgage, creating long-term trust and loyalty.

Small Details, Big Impact

The Fuel Tank Arrow may be small, but its impact is big—it saves time, reduces frustration, and makes life just a little bit easier.

In mortgage broking, applying this principle means paying attention to the details that can improve your client’s journey.

By offering clear communication, anticipating their needs, and providing personalized care, you can create a smooth and stress-free experience that will set you apart as a trusted, client-focused mortgage broker.

Just like that arrow on your dashboard, sometimes the smallest gestures lead to the biggest rewards!

To find out more about how our mentoring programs can help you and your business, contact us.